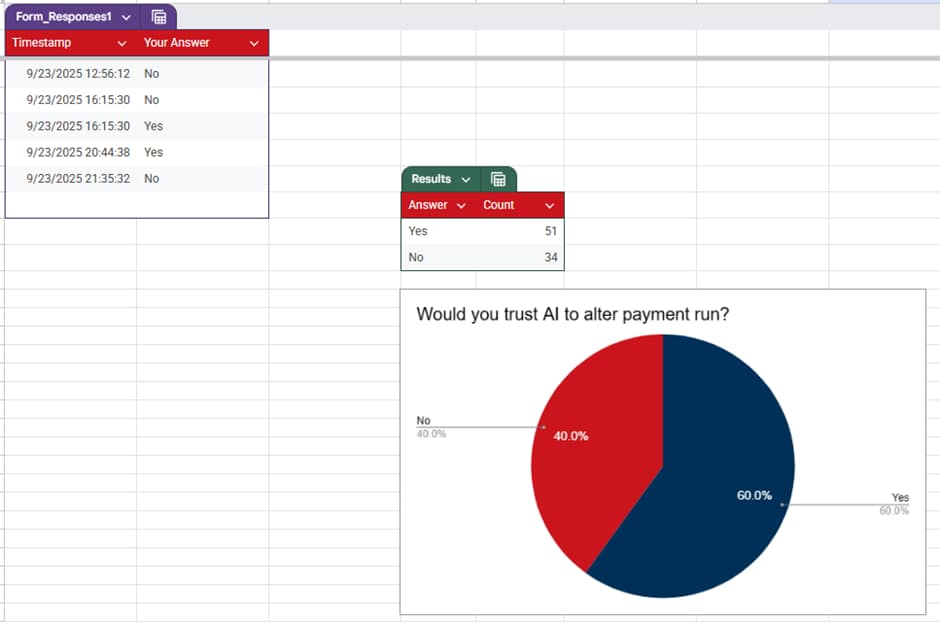

During my recent seminars at financeSHOWCASE, I’ve been asking the audience a simple yes-or-no question: “Would you trust AI to adjust a payment run if it found better terms or early settlement discounts on an invoice?”

I’ve been tracking the responses in a Google Sheet, and the results have been interesting. My aim in asking was twofold. First, I wanted to gauge how “AI ready” finance teams really are. Second, I wanted to spark debate, because this isn’t truly a yes-or-no type of question. My hope was that people would push back on the simplicity of it and open up a conversation about the bigger picture.

On the surface, it feels logical to say that if Document AI can recognise an early settlement discount, calculate the savings, and adjust the payment run, then it should. But once we consider broader factors such as cashflow management, multiple bank accounts, and competing invoice discounts, things quickly become more complex. Having one tool make an important decision based on a single document can be risky at best.

An alternative is a “human in the loop” approach: the Document AI highlights the discount and the potential saving, then passes it to a decision-maker for action. The downside here is that this process could become repetitively manual and ultimately wearisome.

Looking ahead, it’s easy to imagine a more sophisticated scenario, where a Document AI agent communicates with a Cashflow AI agent to support better, more holistic decision-making.

Personally, I still advocate for keeping humans in the loop. But AI can play a valuable role by filtering out unachievable opportunities and surfacing only those with genuine potential. That way, finance teams face the fewest possible decisions while working with the maximum amount of actionable data.

Importantly, Cashflow AI agents would need to be tailored to specific industries. The cashflow profile of a building society looks very different to that of a large plumbers’ merchant, for instance.

The responses I’ve gathered so far suggest that finance teams are increasingly open to letting AI take a role in decision-making. However, the conversations these questions have generated make one thing clear: it’s not as simple as it might first appear.